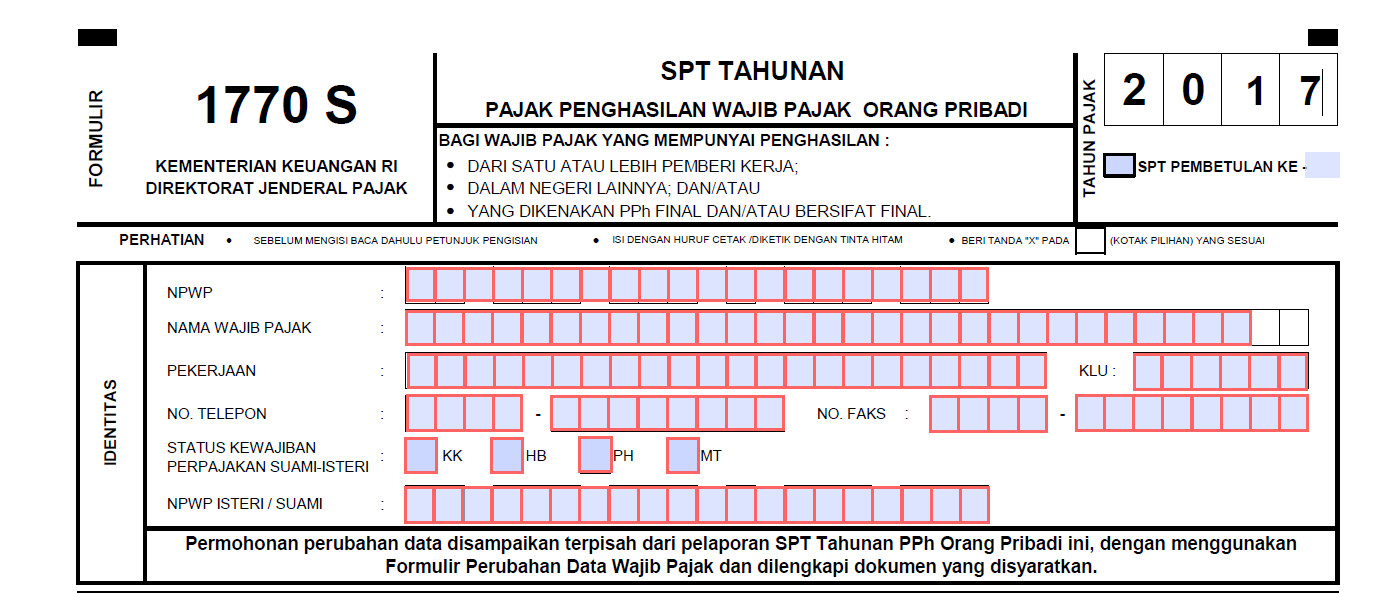

Part C, the yellow field number 9 is automatically generated but can be changed by clicking Menggunakan Perhitungan Sendiri check box.Part B, fill your status as stated in your tax withholding slip 1721.Identity part: fill your job (Pekerjaan) – Pegawai Swasta / 96304, Fill your Phone number, choose KK for tax status.Part C, complete this part as your Tax withholding slip 1721 from your company (It should state your net income and your tax within a year that taxed already)Lampiran I.Part B, complete if you have any non tax object income,.Part A, complete if you have any other income aside from your employers such non-bank interest, royalty, etc.Menu Surat Pemberitahuan (SPT) > 1770S >.Part D, complete the part by inserting your family information1770S > Lampiran II.Part C, complete the part by inserting your liabilities / debts per 31 December 2018.Part B, complete the part by inserting your asset list per 31 December 2018.Part A, complete any income related to final tax.Menu Surat Pemberitahuan (SPT) > Buat SPT Baru > Jenis SPT Tahunan OP 1770 S > Tahun Pajak 2018 > Pembetulan ke- 0.Set non-taxable income in utility > PTKP > fill as following:.

#Download spt 1770 pdf Patch

Open the application after setup and patch are installed.Fill your tax return in the application:.

#Download spt 1770 pdf install

0 kommentar(er)

0 kommentar(er)